I often hear leaders wondering where AI will be in five to ten years, wishing they had a crystal ball. I think we have a pretty clear idea of where we are going since we have already seen this movie. Let me explain.

The cloud computing story

I believe generative AI is at a turning point. I see similarities now to where cloud computing was in the early 2000s and think that provides some insights.

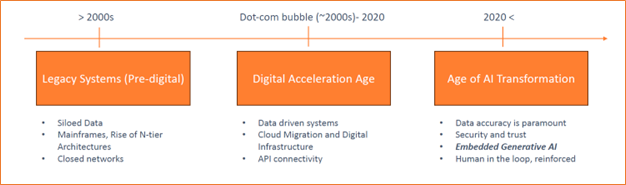

Let’s go back about 20 years when the launch of the internet stimulated a boom in startups. Each of those companies had their own servers—all closed systems that didn’t interact with one another and held siloed data. That boom became a bust in the early 2000s.

The bust was followed by a 20-year period of cloud infrastructure where there was an understanding of the need for open systems that communicated with one another. Amazon steered the way. Their leadership was due in large part to their online stores needing to be open 24/7. Amazon had to build a back-end structure for their own business purposes including things like APIs that could take payments. Eventually Amazon managed their own large server farms. They figured out others needed the same thing and started to rent them out—thus the birth of Amazon Web Services.

This evolution brought us to today where there is little reason to have your own servers, most things need to be connected, and our systems are data- and API-driven. This new, open-systems, cloud-computing model has created tremendous growth in the economy.

AI’s version of the movie

I think that AI’s story will be similar to that of cloud computing, with AI just becoming part of the offerings that we buy. AI will likely be embedded in the products that we use to run our businesses and can be our coach/assistant/right hand. You can plug in any process in your organization, and AI can help—lending business, financial planning, identifying customers in your database to target. Here are some examples that I see coming.

- Database solutions. Businesses are run on data. Data about your prospects, customers, expenses, revenue, everything. Database products purchased to help run your business will come embedded with the AI that you need. You won’t need to hire data scientists to create your own AI. Rather, off-the-shelf products will allow you to chat with your data using AI—to ask it, in natural language, for a report that considers all your data from your P&L. You can ask it to first summarize the last five years in charts and text, then forecast out five years, considering various assumptions. You can request the report to include specific charts, cover specific topics, and whatever else you need. The AI you need will likely be included in your database application to help you easily interrogate and explore your data.

- Wealth management. Financial planning will likely be transformed. You can tell the AI-imbedded planning tool that you want to retire in five years and you will need $X per month in living expenses. You can ask it to model out various scenarios, build a portfolio for you, and stress test that portfolio in various ways—maybe two recessions during your retirement. You can ask it to show charts with asset draw downs and other visuals.

- Content generation. Writing marketing content can be simpler. You can ask the AI-empowered content tool to target your top prospects and create a series of communications that can highlight the benefits they most care about. The tool can calculate how special offers might be used to prompt purchases. The tool can then schedule the communications, execute them, and provide performance reporting.

Saifr also provides an example of embedded AI. We offer a workflow tool, use your data, and overlay both with intelligence on financial regulations. We are enabling a business transformation. We will see the same in other industries as tech companies start to embed AI into their systems.

In 10 years, AI will likely assist with everything—scheduling, extracting data, writing reports, writing business plans, etc. Just like cloud computing, it can be ubiquitous and seamless to users. It will be as if each application you use contains an analyst who does a lot of the work for you. We will wonder how folks accomplished anything without these “easy buttons.”

Several implications

As we travel down this path, here are some implications to consider:

- Leaders should focus on data quality since its accuracy is critical to building trust in the AI of tomorrow. Quality data will be invaluable and hard to acquire; and if you have it, it can enable you to move faster to gain a competitive edge.

- Leaders need to consider embedding AI into their products, otherwise their competitors who did include AI will likely win.

- Be intentional about how and where humans are included. We need to oversee what data the AI is using, the prompts, and the results. We provide the necessary checks and balances. And, only human intelligence and judgement can predict and handle dynamic industry changes, such as new products or new regulations, that often need interpretation.

- Business leaders should plan how to set up their teams for success. The workforce needs to be educated in how to best use these new AI tools. We currently measure productivity in terms of “doing.” When that becomes automated, how do you measure the success of the “thinking” that will replace it? When more entry-level work is automated, how do you create employees with experience?

We’ve seen this movie before; the ubiquity of AI can be a catalyst for growth. I think this growth will start in the next five to seven years. Once AI is more mature and absorbed into products, we will likely see an accelerated growth rate. Leaders should strategize and begin taking actions now to make the most of the transformation that is coming.

The opinions provided are those of the author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information. Fidelity and any other third parties are independent entities and not affiliated. Mentioning them does not suggest a recommendation or endorsement by Fidelity.

1103532.1.0

-1.png)