Strengthen your AML/KYC program with adverse media screening and sanctions monitoring alerts

Uncover more relevant alerts

- Discover potential bad actors in your customer and vendor populations

- Review potential risk alerts for further investigation

- Get extensive coverage from across the internet and threat/risk lists

- See results for a wide range of crimes that may increase AML risks

Increase efficiency

- Monitor your customer and vendor populations continuously

- Reduce false positives to avoid unmanageable backlogs

- Enhance client onboarding and integrate into your existing processes

- Enable scalability of your AML/KYC program

Bolster ongoing risk management

- Receive real-time alerts for your customer and vendor populations

- Get early warning of potential changes in entity risk profiles

- Protect your organization with alerts from sources that are constantly growing and evolving

We crawl and index over 230K online sources worldwide 24/7...

190 countries

160 languages

23 billion webpages

1.5 million webpages added daily

...to help you comply with regulatory requirements and guidelines that matter.

AML/KYC risk management that's effective and efficient

Finds up to 7x the number of potential bad actors

Crawls and indexes data 24/7

Surfaces fewer false positives

Based on 2021 assessment with a large financial institution. Client improvement experiences are for representative purposes only. Results may vary based on different factors unique to a financial institution and its customer base.

SaifrScreen surfaces results for a wide range of potential risks...

Terrorism

Financial crimes

Violent crimes

Regulatory violations

Money laundering

And more

... based on OFAC sanctions lists and a variety of types of adverse media:

Politically exposed persons (PEPs)

Wanted/watch lists

News media

Marijuana-related businesses (MRBs)

And more

Bulk adverse media monitoring with wider coverage and higher precision

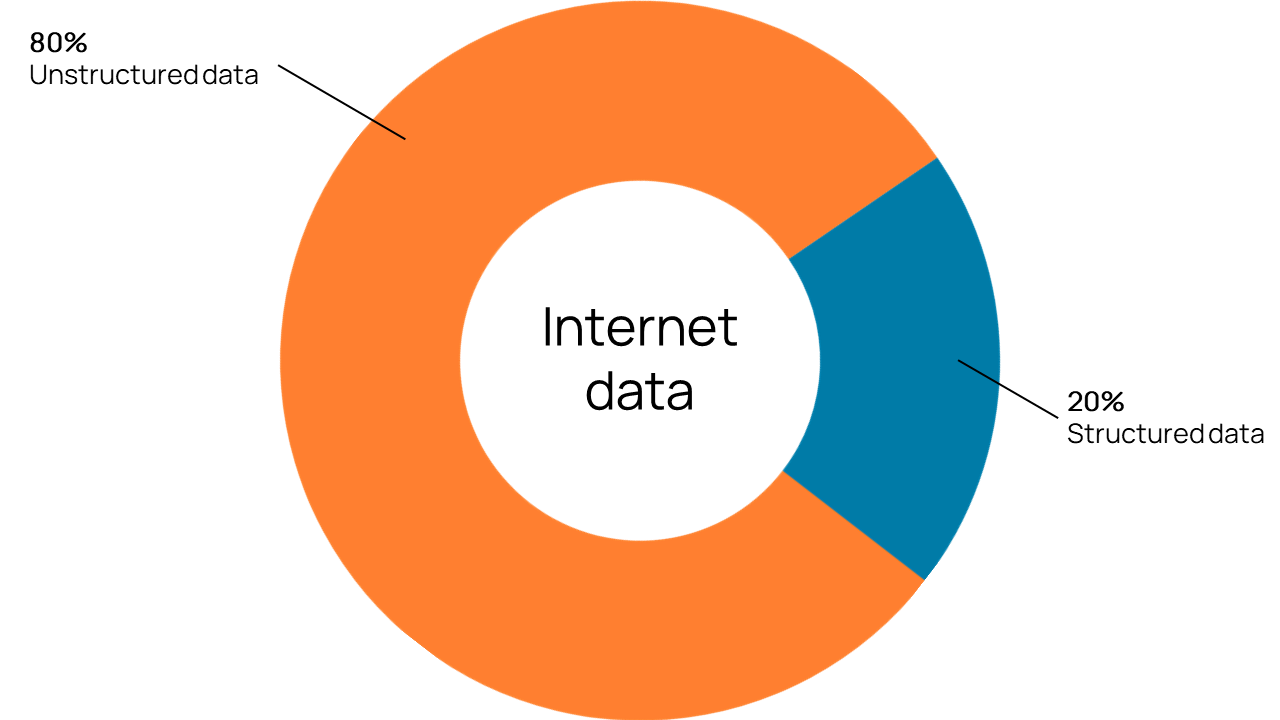

SaifrScreen can be far more precise than other industry offerings because we leverage unstructured data and layers of AI to better match searches to potential risks.

SaifrScreen uses targeted, unstructured data to expand coverage and alert on potentially risky leads.

Most vendors only search structured data like sanctions lists, watchlists, and Most Wanted lists—but those lists can be slow to be updated. SaifrScreen provides expansive coverage by indexing unstructured data to catch potential risks as soon as any association occurs.

Unstructured data may include:

- Government sources

- Arrest record aggregators

- Court record aggregators

- News

Unstructured data contains valuable information that many other providers can’t capture.

Extensive coverage doesn’t mean better results unless you’re using layers of sophisticated AI—like we are.

SaifrScreen’s AI agents find the highest probability risk matches, so you aren’t buried by false positives.

We use layers of cascading AI models to filter large amounts of data into more relevant risk alerts. Our LLMs and NLP models feed into one another to understand the details and sentiment of adverse media sources, enabling more precise matches of searches to potential risks. With SaifrScreen, one of our clients effectively monitors 50 million customers with just 2.5 analysts.

Based on 2021 assessment with a large financial institution. Client improvement experiences are for representative purposes only. Results may vary based on different factors unique to a financial institution and its customer base.

Details and capabilities

Helping you focus on what matters

Helping you focus on what matters

- Precision: AI, NLP, LLMs, and behavioral science come together to read and understand context, enabling SaifrScreen to gauge whether potential risks are relevant to the entity being searched.

- Prioritization: Results are ranked in relevance order so you can investigate the highest probability risks first.

- Bulk monitoring: SaifrScreen can monitor your entire customer and vendor populations.

- Data privacy: SaifrScreen is SOC 2 Type 2 certified and indexes names and adverse media sources separately to respect and support individuals’ privacy.

Meeting your custom needs

Meeting your custom needs

- Customization: We’ll tailor our AI models to show the specific date ranges and types of crimes you need to monitor.

- Fine-tuning: Clients can choose to provide proprietary data to help improve risk relevance in their instance of SaifrScreen.

- Feedback: Users provide feedback to our AI models by clicking thumbs up/down to rate the result’s accuracy, helping the models become more precise over time.

Pricing is volume based. For more information, contact Sales.