If you’ve been following our blogs, you know that over the past few months we’ve been sharing data, insights, and lessons learned from our ebook, The struggle is real: Overcoming hurdles in content creation and review. We’ve highlighted the top challenges of compliance and marketing departments, including an increasing volume of work and the need for tools that can help teams collaborate more effectively. In this blog, we dive deeper into the data to discuss some interesting differences within those departmental challenges.

Top three challenges

To recap, the 107 junior, mid-level, and senior leaders and top executives we surveyed from marketing and compliance departments at leading U.S. financial institutions all agree—volume of work is up. Leaders attribute the growth to factors such as increased and evolving regulations, new products and services, and more marketing channels. These factors are creating operational challenges for marketing and compliance leaders. However, leaders rank ordered their specific challenges differently.

Marketing leaders, for example, say their top three challenges are budget limitations, time spent on content creation, and (tied for third) too many platforms used in creating content and too many delivery platforms.

The survey was conducted online in September 2023 and included 48 marketing and 59 compliance executive, senior, and junior leaders from various financial institutions that are based in the U.S.

The survey was conducted online in September 2023 and included 48 marketing and 59 compliance executive, senior, and junior leaders from various financial institutions that are based in the U.S.

For compliance leaders, their number one challenge is a three-way tie between the volume of reviews being too great (given the current number of reviewers), difficulty in determining review priority, and a lack of system integration. In second and third place on their list are the number of rounds of reviews / feedback required and version control / recordkeeping, respectively.

The survey was conducted online in September 2023 and included 48 marketing and 59 compliance executive, senior, and junior leaders from various financial institutions that are based in the U.S.

The survey was conducted online in September 2023 and included 48 marketing and 59 compliance executive, senior, and junior leaders from various financial institutions that are based in the U.S.

Data from marketing leaders suggest their teams are struggling to meet organizational needs for content creation and either lack tools—or don’t have the right tools—to help. Compliance leaders’ responses suggest their departments may already have solutions or tools in place, yet it seems their tools have limited capabilities to help them review work priority, manage version control, and integrate with other systems.

The general takeaway is, although marketing and compliance teams have different operational challenges, they both could benefit from better tools for collaboration and workflow management. A deeper look at our data reveals where those workflow gaps exist within and between teams and roles.

Percentage of content reviewed by compliance teams

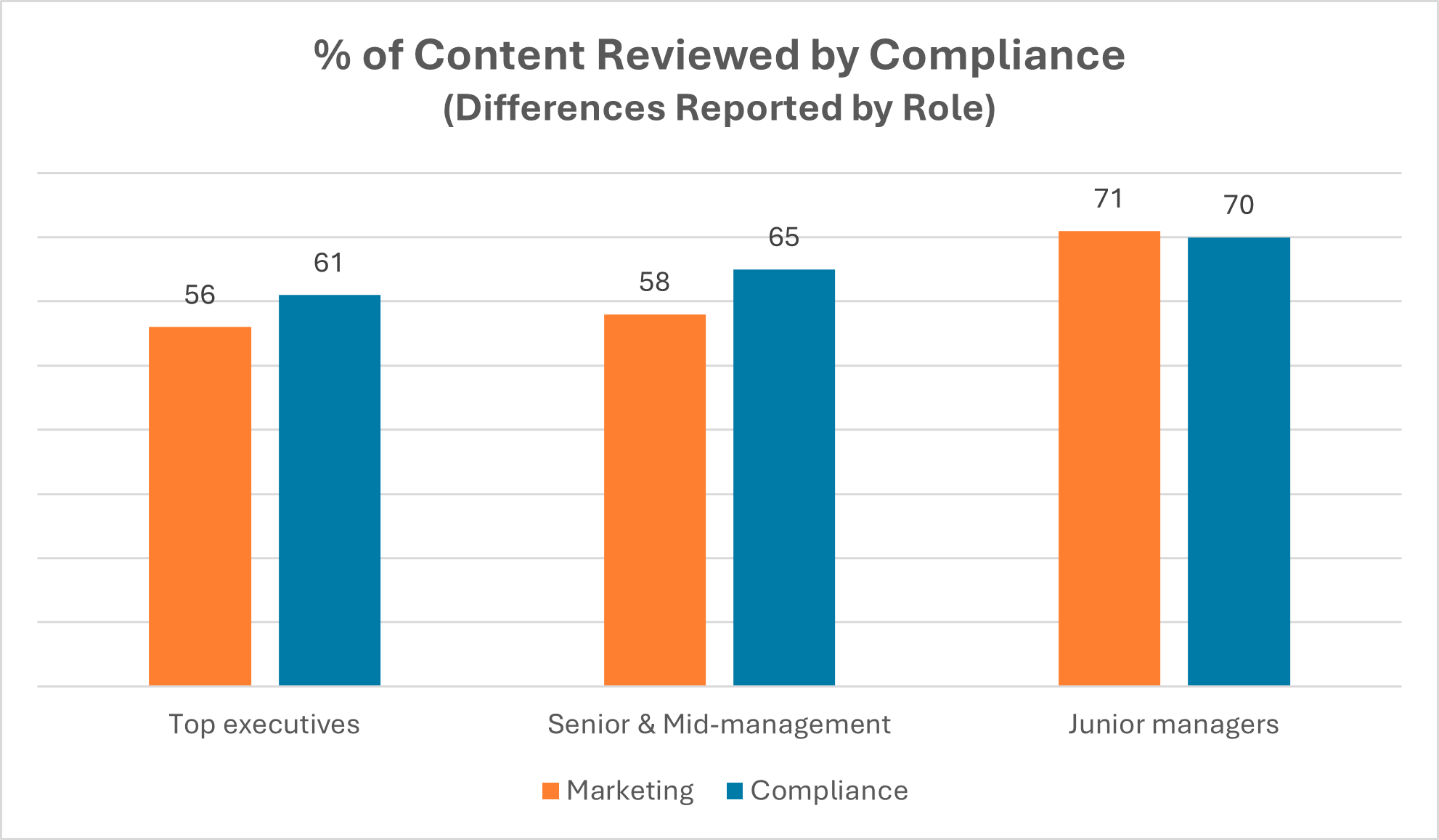

Marketing and compliance managers gave us differing responses regarding the volume of marketing content being reviewed by compliance teams. Not surprisingly, compliance managers said it’s high—anywhere between 65% and 70%. Marketing leaders, on the other hand, estimate 58% to 71% of their content gets reviewed by compliance.

Why the dissimilar range from marketers? One reason may be the varied responses by managers at different job levels. For example, senior marketing managers estimate 58% of all marketing content undergoes review by compliance. But that value is higher for junior managers, who estimate approximately 71% of their team’s content must be reviewed and approved by compliance.

The survey was conducted online in September 2023 and included 48 marketing and 59 compliance executive, senior, and junior leaders from various financial institutions that are based in the U.S.

The survey was conducted online in September 2023 and included 48 marketing and 59 compliance executive, senior, and junior leaders from various financial institutions that are based in the U.S.

Gaps in perception exist within compliance leadership, as well. Senior compliance leaders estimate their teams are reviewing 65% of the content created by marketing, while junior managers say that value is closer to 70%. One explanation for these differences could simply be tied to workflow, as junior managers in both marketing and compliance may have greater hands-on task work on a daily basis, while higher-level managers may have a more holistic view of operations. The possibility also exists that senior managers—especially in marketing—may not fully understand the day-to-day regulatory burden on compliance teams.

Length of content reviews

The marketing and compliance leaders that participated in the survey did provide similar answers when we asked how many working days it took to create and approve a piece of marketing content. Marketers responded it took, on average, 10 working days to create a piece of content, with six to eight of those days devoted to compliance review. Compliance leaders say it takes them an average of six days to review a piece of content. No major discrepancies there.

What is curious are the differences in how long it takes marketing functions in different sub-sectors of the financial industry to create and get approval for a standard piece of marketing content.

Most marketing leaders say total time to create content is between six and 10 days, with 61% to 81% of that time devoted to compliance review. For teams that work in the wealth management subsector, reported turnaround time is over 10 business days, but content review only consumes between 41% to 60% of that timeframe. Investment brokerage marketing departments also claim their content spends about 41% to 60% of the time in review by compliance departments, but their estimated total time is similar to marketing departments in other sub-sectors (six to 10 days).

Rounds of review required for approval

Compliance team leaders mention the number of rounds needed to approve content as one of their top challenges. When we compare the number of rounds of review marketing leaders say their content must go through to get approval, in some cases it’s more than double the amount cited by their compliance counterparts.

Marketing respondents, on average, say their content goes through six rounds of review with compliance before it is approved for use. Compliance leaders estimate they complete an average of four rounds of review before sign-off. The difference is even greater when we look at the data by department size.

The survey was conducted online in September 2023 and included 48 marketing and 59 compliance executive, senior, and junior leaders from various financial institutions that are based in the U.S.

The survey was conducted online in September 2023 and included 48 marketing and 59 compliance executive, senior, and junior leaders from various financial institutions that are based in the U.S.

The chart above shows leaders from large marketing departments estimate it takes 10 rounds of review for marketing content to be approved by compliance. Leaders from large compliance departments estimate it takes less than half that time. Why the discrepancy between large marketing and compliance departments? And why don’t the values equal each other across all department sizes?

Actual department size could be a factor in the workflow. The size of our surveyed firms’ marketing departments varies widely, meaning, comparisons with compliance department size is not apples-to-apples. For example, a typical financial services firm may have an average of 15 people on their compliance team. In our survey, a majority of marketing respondents list their department size anywhere from one to 19 people. Marketing leaders from large financial institutions (the minority) listed their department as having between 20 and 99 employees.

It may be that larger, more mature marketing departments are including reviews by senior marketing leadership as a first step in the overall compliance process, thus lengthening the total time for compliance approval. We didn’t include a question in our survey that would help determine if this is true, so it’s only speculation on our part. The heart of the issue, though, is that discrepancies in data suggest these organizations lack collaborative workflow platforms that provide full visibility and understanding into the content creation and compliance review process from end to end.

Tech solutions can help close the gaps

Did any of these differences surprise you or make you wonder what the data gaps are between your marketing and compliance departments? When it comes to creating financial services marketing content, many teams are involved and each may not fully understand the tasks and processes required to create, review, and approve content from end to end. That’s why we advise clients to consider a collaborative platform that supports content creation and review. Technology solutions like Saifr were created to help bring visibility to these processes so stakeholders across departments can easily track the progress of content development and work efficiently as a cohesive team to help ensure compliance.

Interested in the full research? Download our ebook, The struggle is real: Overcoming hurdles in content creation and review.

The opinions provided are those of the author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

1150265.1.0

-1.png)