Imagine your next vacation: You use a ride-hailing app to get to and from the airport, settle into a cozy apartment rented via a home-sharing platform, and sample local cuisine without leaving your apartment—ordering meals from nearby restaurants through a food delivery app. Every service used is powered by digital technology that instantly connects you with providers, eliminating the friction of traditional bookings. Your journey is not only convenient but also personalized, made possible by a combination of tech and a gig- and sharing-economy that’s designed to match supply with demand in real time.

Digital technology has changed how we make purchases

The scenario above is an example of how traditional person-to-person transactions have been replaced by seamless, virtual exchanges in today’s digital marketplace. What was once a direct transaction between two parties is now a customer journey that runs through a platform or service provider plus a third-party contractor. The journey is designed for convenience—for the consumer, merchant, and contractor. Yet beneath this convenience lies a delicate balance of trust.

We wanted to know how much trust and other factors influence consumers’ purchases in this digital-empowered, sharing-services economy. To find out, we worked with research firm MarketSight to survey 1,000 U.S. consumers ages 25 and over.

Consumers are using sharing services frequently

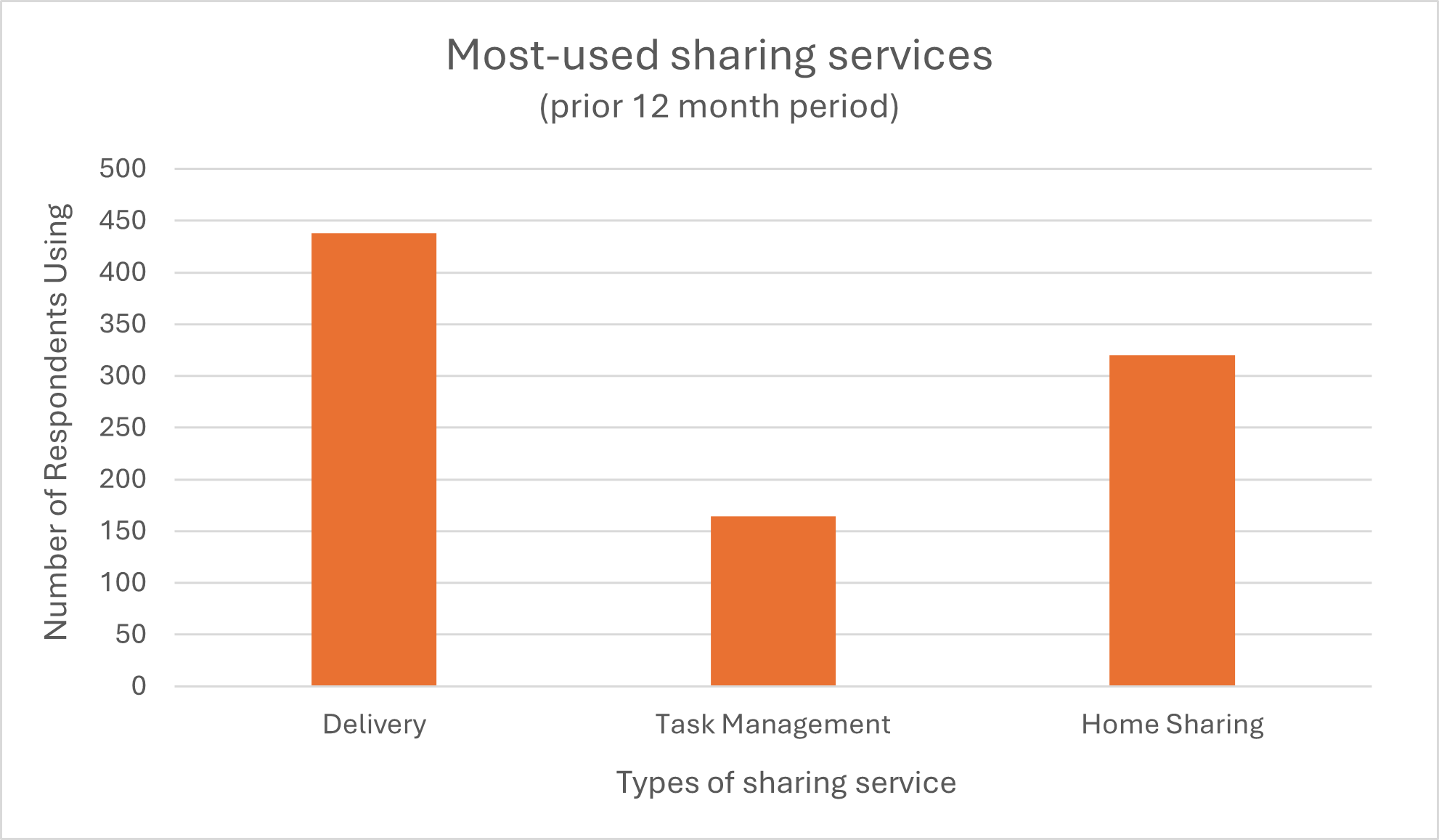

Over half of the survey respondents (57%) said they used at least one type of sharing service in the 12 months prior, with many responding they’ve used more than one. When asked which types they used the most—home-sharing, task management, or delivery services—77% said they were using delivery services. Home sharing was the second-highest type of service used (56%). Slightly less than a third (29%) said they used task management services.

The survey group are using these services weekly and monthly, with weekly being the most frequent cadence. With deliveries as the most used services, one takeaway is that consumers are actively relying on delivered goods on a weekly basis. Tying this back to trust, the hypothesis is that if consumers are using and relying on sharing- and gig-economy services often, they must have some level of confidence in or assurance from the service being provided. But to what extent? And how does that compare with other factors, such as cost, quality, and safety?

Cost drives choice, but consumer risks and safety are also top-of-mind

Just over half of the consumers surveyed (52%) said cost is the most important factor when considering the use of sharing services. This is not surprising. According to research summarized in a 2023 Harvard Business Review article, pricing and price shifts influence consumer buying decisions. But other priorities are also important to our surveyed consumers.

For example, consumers were asked to rank the potential risks of using sharing services. Their top three concerns are personal safety (58%), data privacy (52%), and fraudulent charges (52%). When asked how safe they feel using home-sharing, task management, and delivery services, respondents said they felt the safest using delivery services. This could be attributed to the fact that door-to-door delivery does not typically require the contractor to enter the home.

These data tell us that consumers put significant emphasis on an organization’s ability to safeguard them and their data when selecting services.

| 74% of consumers felt “safe” or “very safe” using delivery services |

The focus on safety can present challenges for sharing-service platform providers who may employ multiple contractors that need to be vetted before service can be provided. However, organizations can also turn this security-focused challenge into an opportunity to establish a reputation for prioritizing consumer safety.

Steps organizations can take to build trust and help consumers feel safer

The survey data give service platform owners insight into where they could prioritize consumer safety to potentially boost usage, win new customers, and grow market share. Based on consumers’ responses, organizations should consider taking a strategic approach to protecting consumers’ safety in three main areas to help build trust:

- Personal safety – Protect consumers by instituting a robust contractor and merchant risk management program that can include identity verification, adverse media screening, and monitoring. Tools like SaifrScreen℠ can be a part of that program with artificial intelligence capabilities that continuously monitor adverse media for potential risks and identify red flags for further investigation to prevent transacting with bad actors.

- Data safety – Safeguard consumer data to prevent privacy breaches and identity theft with secure digital systems and sound human resources policies for service providers, such as thorough onboarding and frequent background checks.

- Financial safety – Protect consumers from unauthorized charges by implementing secure payment systems that include fraud detection and defined dispute and resolution processes.

Safeguarding consumers’ personal, financial, and data safety is a significant responsibility for organizations to undertake, but each consumer transaction represents a digital handshake between strangers—a leap of faith where both consumer and provider must rely on platform safeguards. While most service providers fulfill their promise, the potential for poor service, fraud, or worse lurks in the shadows of these tech-enabled exchanges. By understanding consumer concerns and implementing robust safety measures, organizations can not only address consumer concerns and build consumer trust but also differentiate their brand in an increasingly competitive market.

To learn more, download the white paper, How trust drives the sharing economy: Our new survey confirms safety sells.

Saifr's products and services include tools to help users identify potential leads for further investigation. Saifr is not a consumer reporting agency as defined under the Fair Credit Reporting Act (FCRA), and Saifr's products and services may not be used to serve as a factor in establishing an individual’s eligibility for credit, insurance, employment, benefit, tenancy, or any other permissible purpose under the FCRA. Saifr's products and services do not include and are not permitted to be used for background checks. Saifr's products and services are not intended to replace the user’s legal, compliance, business, or other functions, or to satisfy any legal or regulatory obligations. All compliance responsibilities remain solely those of the user.

1195106.1.0

-1.png)