Videos are an important and growing part of the marketing mix for US financial services companies. Video are engaging, easy for the target audience to digest, help show brand personality, and can be very effective. Why wouldn’t marketing be using them more and more?

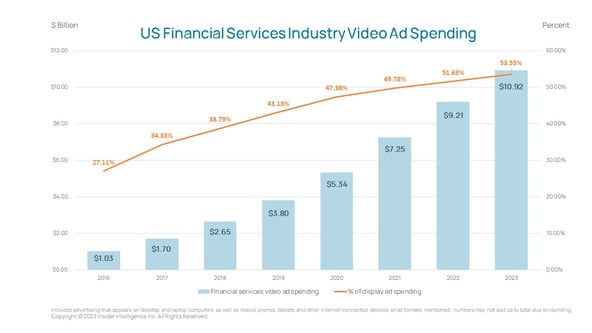

As shown in the chart below, video ad spending is increasing, as is the percent of the overall budget attributable to videos. And in addition to video ads, there are televised interviews, webinars, podcasts, and what seems like more types every day.

When I was a compliance reviewer, a video review would take me so much longer to notate and mark each timeframe. I would listen to each video a few times, pausing and restarting multiple times to make sure I caught everything.

While video formats are gaining favor with marketers, they can create headaches for compliance reviewers. Let’s explore how videos are often a time sink for reviewers both in helping to create them and in reviewing them after delivery.

Live compliance review

One of the ways compliance assists is by attending the live recording in the studio to help expedite the compliance review. The reviewer is “on call,” speaking up during filming to suggest word changes as the recording is taking place. Based on the comments, there can be retakes and edits. The whole thing can be very time consuming and even a bit awkward. There is also the challenge of scheduling talent and compliance at the same time in the studio. Involving compliance in the development process is helpful to get ahead of issues and avoid total reshooting, but it does complicate the process for both marketing and compliance. And it can push already overworked compliance staff to the brink.

Ebook | The struggle is real: Overcoming hurdles in content creation and review

Reviewing after the fact

Probably more video formats are reviewed after the fact. Once the webinar or interview has been recorded, marketing often repurposes it to create additional assets to send out via multiple distribution channels. Here compliance often can’t just “read” the video and give feedback—it is a video after all! Not that long ago compliance would need to review the video by watching, pausing, stopping, rewinding, etc. Now, a video can be sent out for transcription, but that can take a long time and come back less than perfect. For example, most transcription services won’t understand financial terms like mutual funds and 401(k)s. Often there is a time crunch to get an interview out as soon as possible while it is still newsworthy. Compliance can bear the ire of their marketing colleagues due to the time it takes to get the transcription and review it.

How AI can help

The good news for compliance folks reviewing video formats is that AI, specifically large language models (LLMs), is coming to the rescue to make life easier! It’s time to start exploring the options available. LLMs can help translate the video audio into text in seconds or minutes, which saves the time and cost of transcription services. Financial-trained models will understand industry terms and transcribe them more accurately. Also, compliance-trained models can isolate and highlight non-compliant content making it easier to review the video from a compliance perspective.

Videos are growing in popularity and tools are available to help compliance meet the demand.

More about how to streamline compliance reviews can be found in our ebook, The struggle is real: Overcoming hurdles in content creation and review.

The opinions provided are those of the author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

1090772.1.0

-1.png)